2022 Gift Tax Biggest Reporting Issues and Mistakes

Historical Annual Gift Tax Exclusion

1997 - 2001 $10,000

2002 - 2005 $11,000

2006 - 2008 $12,000

2009 - 2012 $13,000

2013 - 2017 $14,000

2018 – 2021 $15,000

2022 $16,000

Lifetime Exclusion

Lifetime Exemption $12.06M

Exemption = Exclusion = Deduction = Credit

· Annual Exemption / Exclusion / Deduction

§ $16,000

· Lifetime Exemption / Exclusion / Deduction

§ 2017- $5,490,000

§ 2021 - $11,700,000

§ 2022 - $12,060,000

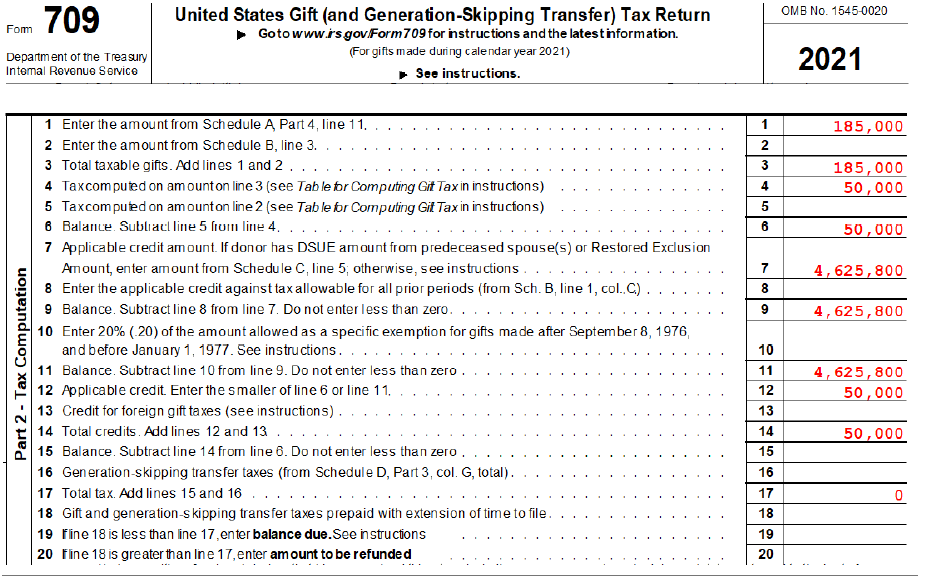

· Lifetime Credit

§ 2017 - $2,141,800

§ 2021 - $4,625,800

§ 2022 - $4,769,800

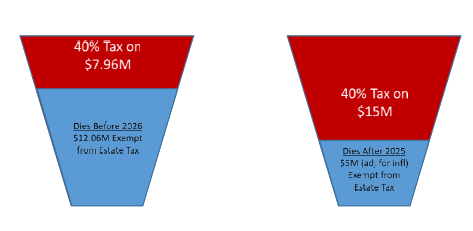

Final Revisions to Treas. Reg. 20.2010-1

· Special rule provides that decedent’s credit will be the greater of the amount used during life OR the credit amount existing at date of death. Specifically, the increased BEA is a “use or lose” benefit and is available to a decedent who survives the increased BEA period only to the extent the decedent “used” it by making gifts during the increased BEA period.

When do I need to file gift tax return?

· Gave A Gift > $16,000** to One Donee

· Gift of a Future Interest –Any Value

§ Transfers to trusts

· Gift Splitting with Spouse – Any Value (Spouse needs to be alive and married not for the entire year but needs to be at the time of gifting)

§ Only the donor spouse must file if gift is < 2x annual exclusion

§ If gift is less than $16,000, technically no filing requirement

· Gift to Noncitizen Spouse > $164,000

**Amounts listed are for tax year 2022.

Transfers Which Are NOT Gifts

· IRC § 2503 (e) Exclusion for certain transfers for educational expenses or medical expenses

§ (1) In general Any qualified transfer shall not be treated as a transfer of property by gift for purposes of this chapter.

§ (2) Qualified transfer For purposes of this subsection, the term “qualified transfer” means any amount paid on behalf of an individual—

· (A) as tuition to an educational organization described in section 170(b)(1)(A)(ii) for the education or training of such individual, or

· (B) to any person who provides medical care (as defined in section 213(d)) with respect to such individual as payment for such medical care.

Gift Tax Payment and Penalties

· Similar to income tax returns, arrangements to pay any tax due must be made with the extension.

· IRC § 6651 Penalties Apply to Late Filing and Late Payment of Tax.

§ Late Filing = 5% per month up to 25%

§ Late Payment = 0.5% per month up to 25%

§ Interest

Where to Send Form 709

· Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999

Citizenship

· A Nonresident Not a Citizen of the United States is subject to gift and GST taxes for gifts of tangible property situated in the United States.

· Definition of a nonresident not a citizen of the United States is measured at the time of the gift. Includes someone who

§ (1) was not a citizen of the United States and did not reside there, or

§ (2) was domiciled in a U.S. possession and acquired citizenship solely by reason of birth or residence in the possession.

· Same filing thresholds apply to Nonresident Not a Citizen as a apply to US

Citizens (i.e. > $16,000, Future Interests, Noncitizen spouse thresholds)

· No lifetime exemption applicable to Nonresident Not a Citizen status. Check tax treaties to determine if any exceptions apply.

US Residents / Green Card Holders

· Same rules applicable to US Citizens apply to US Residents or Green Card Holders

§ $16,000 Annual Exclusion

§ Unlimited Marital & Charitable Deductions

§ Lifetime Gift & Estate Tax Exclusion

Death

· Only report gifts made PRIOR to date of death.

· Gifts made by the surviving spouse cannot be “split” after the first spouse dies.

· Annual gift exemption is use it or lose it.

· Tip: Schedule annual gifting at the beginning of the year...just in case

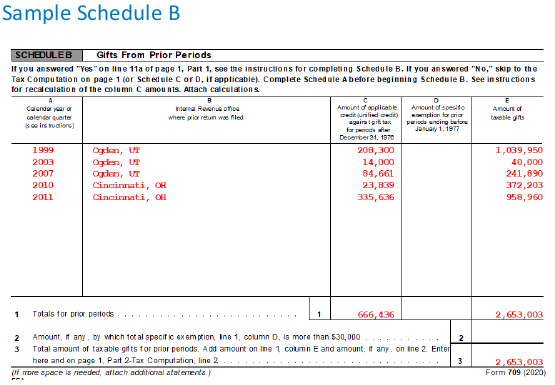

Prior Tax Filings

· Must list all prior taxable gift totals and the credit applied on the current year’s return.

· If Unknown

§ Write to the IRS at the address in the instructions for Form 4506-T

§ Once known, use Form 4506-T for a transcript of the return (free) or Form 4506 for a copy of the return ($50/return).

· Will need this information when filing Form 706 at death too.

§ These are the one returns clients should keep their whole lives (not the 3-or 7-year SOL).

Reporting the Gifts

Schedule A Reporting the Gifts

Part 1 Gifts Subject Only to Gift Tax

Part 2 Gift Subject to Gift Tax and Generation Skipping Transfer (GST) Tax

Part 3 Gifts Subject to Gift Tax and Possibly Subject to GST Tax in the Future

Part 1

Gifts Subject Only to Gift Tax

· Present Interest Transfers to Non-Skip Persons

§ Recipient receives immediate possession and control over asset

§ Recipient is only one generation below transferor or less than 37 1/2 years younger than transferor

· Examples

§ Gift of $50,000 to child

§ Gift of Monet painting to neighbor

§ Gift of life estate to nephew

§ Gift of $100,000 to Alzheimer’s Association

Part 2

Gifts Subject to Gift Tax and GST Tax

· Present Interest Transfers to Skip Persons

§ Recipient receives immediate possession and control over asset

§ Recipient is two or more generations below related transferor or more than 37 1/2 years younger than transferor

· Examples

§ Gift of $25,000 to grandchild’s 529 plan

§ Gift of Zoom stock to neighbor’s newborn grandchild

§ Gift of family cabin to great-nephew

Part 3

Gifts Subject to Gift Tax and Later Possibly Subject to GST Tax

· Transfers to Trusts that have skip persons as possible distributes.

· Examples

§ Transfer of $500,000 to Trust for Son and his children

§ Transfer of stock to Trust for grandchildren’s future education expenses—if not, distributed to charity.

§ Transfer in Trust for children for their lifetimes. Upon death, remainder distributed to grandchildren.

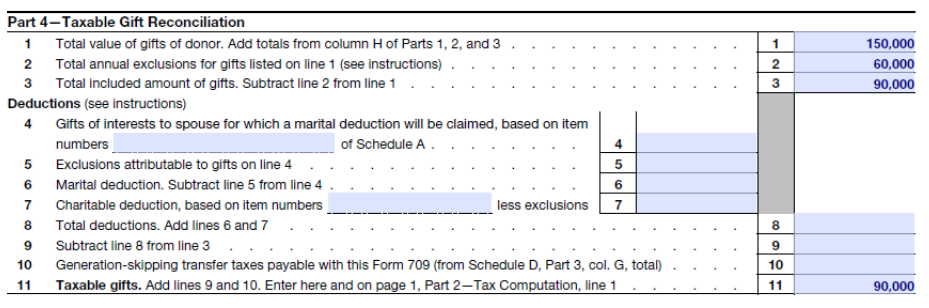

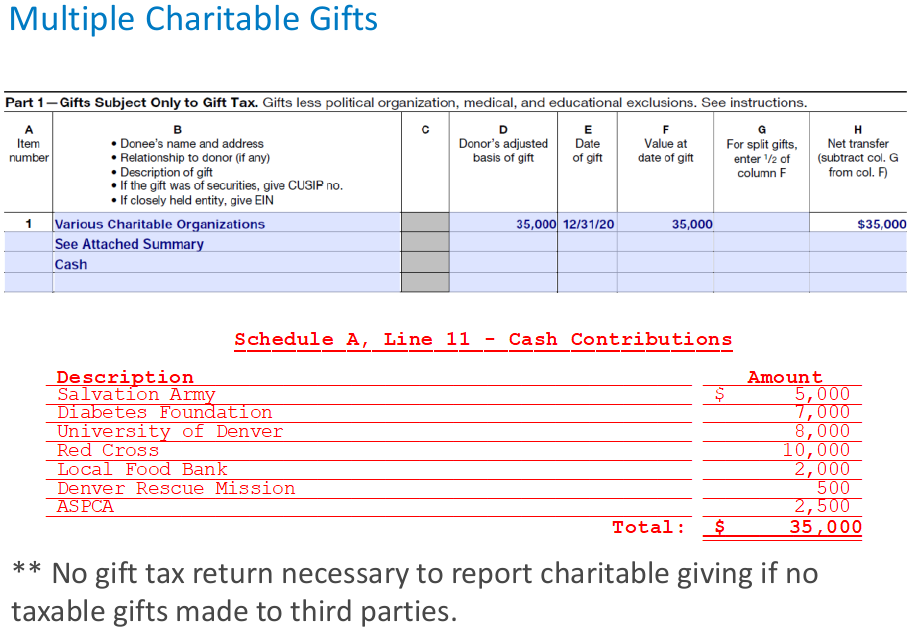

Reporting Charitable Gifts

· Charitable Donations Deductible on Form 1040, Schedule A

· If no other taxable gifts made to third party recipients, then DO NOT file Form 709 to just report Charitable Donations.

· If taxable gifts are made during the year OR the charitable donation is of a partial interest, then charitable donations must be reported on Form 709.

Charitable Donations Not Reportable as Gifts

· Political organizations.

§ Gift tax does not apply to a transfer to a political organization defined under IRC 527(e)(1)) for the use of the organization.

· Certain exempt organizations.

§ Gift tax does not apply to a transfer to any

· civic league or other organization defined under 501(c)(4);

· labor, agricultural, or horticultural organization defined under 501(c)(5); or

· business league or other organization defined under 501(c)(6)

· Provided that such organization is exempt from tax under section 501(a).

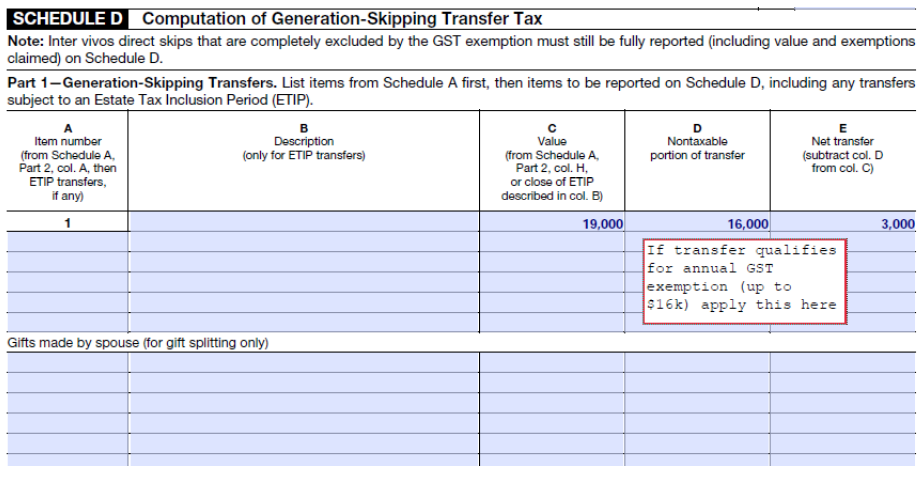

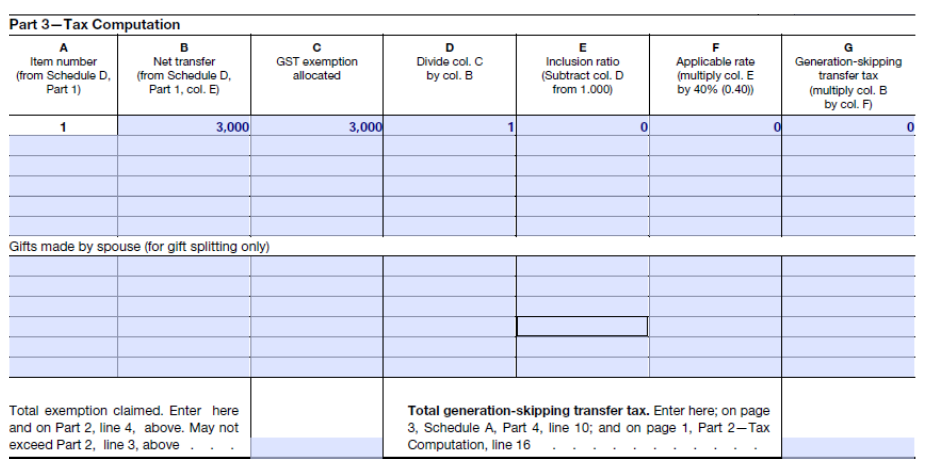

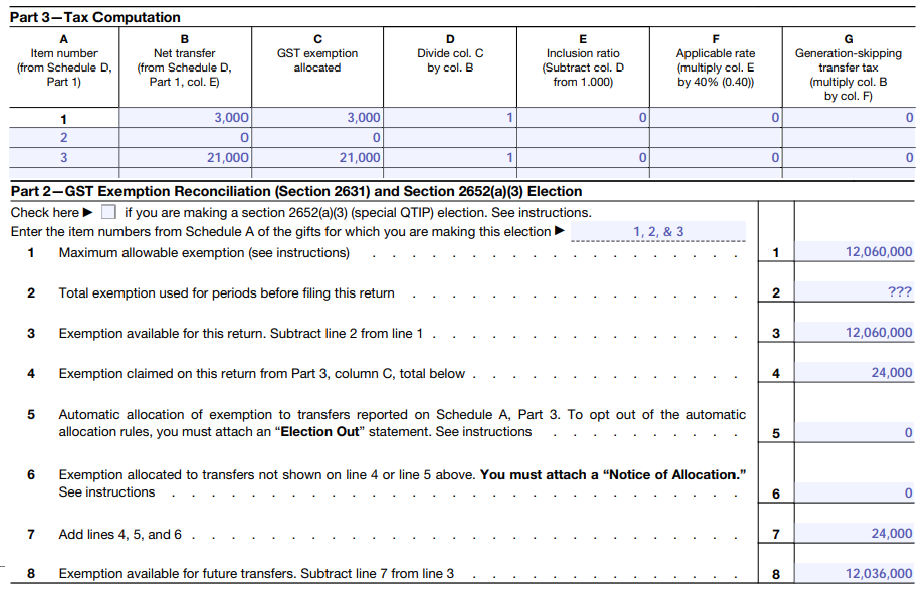

Annual GST Exclusions

· Schedule D, Part 1

§ Allocate the annual exclusion (currently $16,000) to each gift to a skip person listed

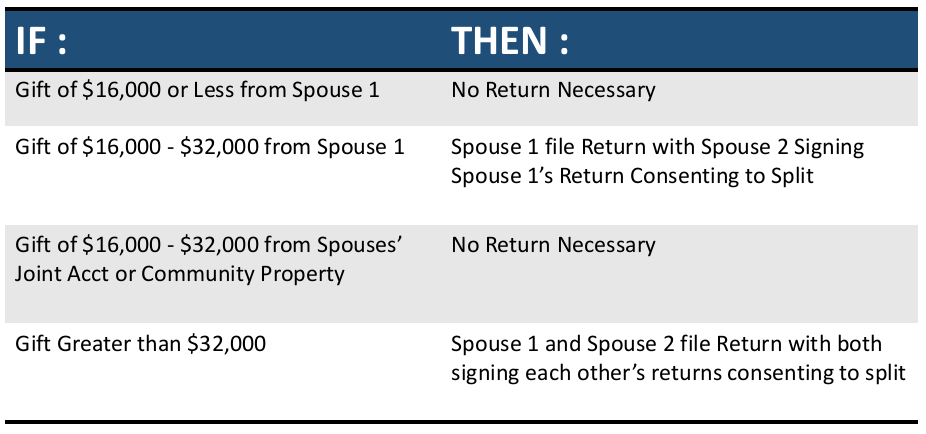

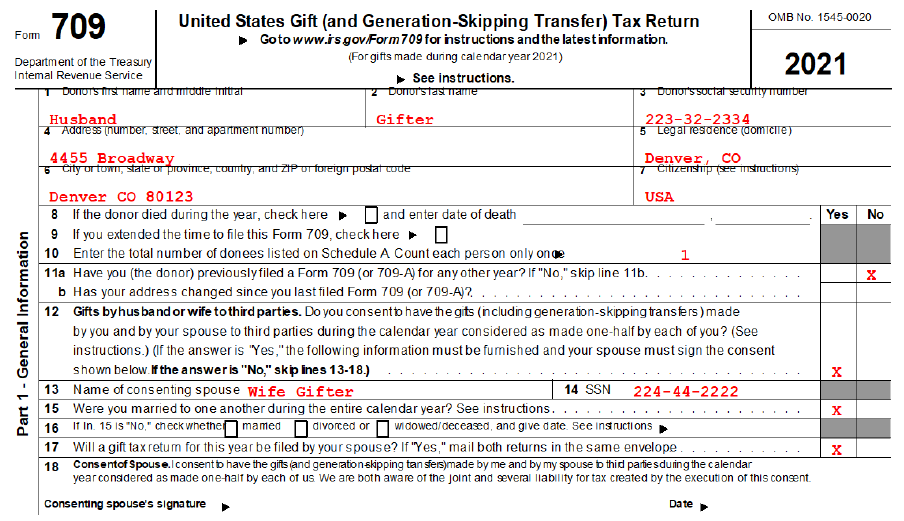

Gift Splitting

Gift Splitting I.R.C. 2513 Gift by Husband or Wife to Third Party

(a) CONSIDERED AS MADE ONE-HALF BY EACH

§ (1) IN GENERAL A gift made by one spouse to any person other than his spouse shall be considered as made one-half by him and one-half by his spouse.

§ (2) CONSENT OF BOTH SPOUSES ...only if both spouses have signified their consent to [the split] in the case of all such gifts made during the calendar year by either while married to the other.

· Factors

§ Spouses Must Be Married (including same sex spouses)

§ Transfer to a third party done during the marriage

§ Both must be alive at the time of the transfer

§ If spouse divorce after the transfer, they cannot remarry before the end of the tax year to split the gifts made during the marriage.

· Reporting Requirements

§ Consent to the split on the gift tax return.

§ All gifts for the entire year must be split (except gifts between spouses).

§ Must mail the gift tax returns to the IRS in the same envelope (applies to all gift tax returns for spouses).

· Both spouses do not have to file gift tax returns if the gifts are under 2x the

annual exclusion.

- I.E. Husband gifts $19,000 to Son.

- Wife may sign Husband’s Form 709 agreeing to the split.

- Does not need to file a Form 709 for herself.

· Primary benefit of gift splitting is that it allows a couple to utilize both of their annual gift tax exclusions ($16,000) to shelter the same gift.

· Example

§ Boat owned by Spouse 1 valued at $24,000. Spouse 1 wants to gift boat to Son.

§ If Spouse 1 alone transfers Boat to Son, then Spouse 1 shelters $16,000 from gift tax and must use $9,000 of the lifetime exemption to shelter the remainder from tax.

§ If Spouse 1 and Spouse 2 agree to split the gift of the Boat, then each will use $12,000 of their $16,000 annual exclusion and neither must use their lifetime exemption.

§ Only Spouse 1 needs to file the gift tax return.

· Gift Splitting is not necessary when a spouse transfers as asset that is community property or titled in joint tenancy.

· Example

§ Spouse 1 wants to transfer $20,000 to Child from Spouse 1 and Spouse 2’s joint bank account.

§ Spouse 1 and Spouse 2 do not need to elect gift splitting in order to “split” the gift.

§ Each may simply report a portion of the gift on their individual gift tax returns (or, if no other gifts were made, not file a return at all since the transfer is under the exemption).

· All Gifts Must be Split for the Year

§ Example

· H&W give their granddaughter $25,000 for her 25th Birthday in January with the understanding that the gift would be split.

─ The money is transferred from Wife’s separate bank account.

· In September, Wife’s former spouse falls on hard times and she decides to give him $30,000.

· Husband hates Wife’s former spouse and does not want to split the gift as a matter of principal.

· Either the couple must agree to split both the gift to granddaughter and the gift to the former spouse, or Wife will report $25,000 gift to granddaughter and $30,000 gift to former spouse.

· Both gifts are over the annual exclusion. Wife must use $10,000 of her lifetime exclusion to cover granddaughter’s gift and $16,000 to cover former spouse’s gift.

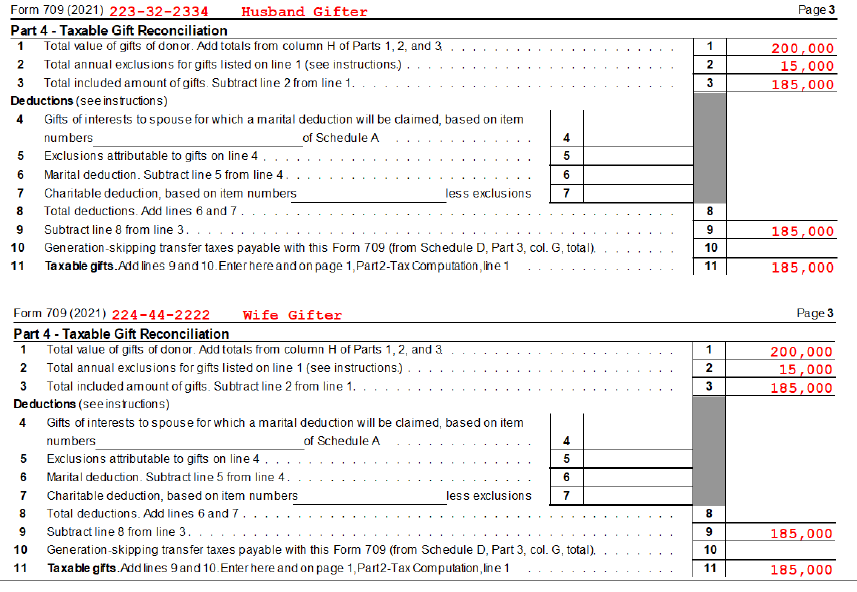

· Example

§ Husband gifts real estate worth $400,000 to his daughter. Wife agrees to split the gift.

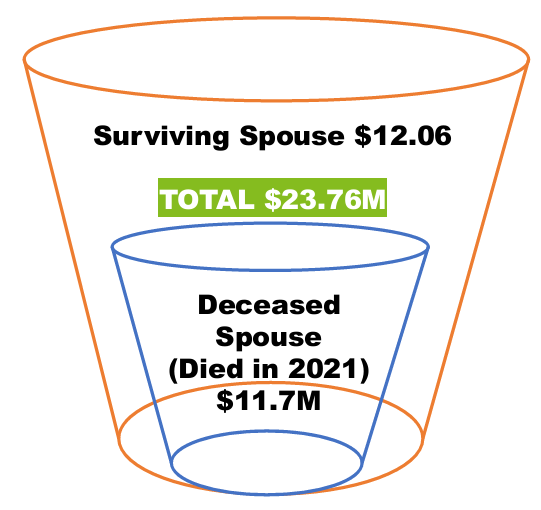

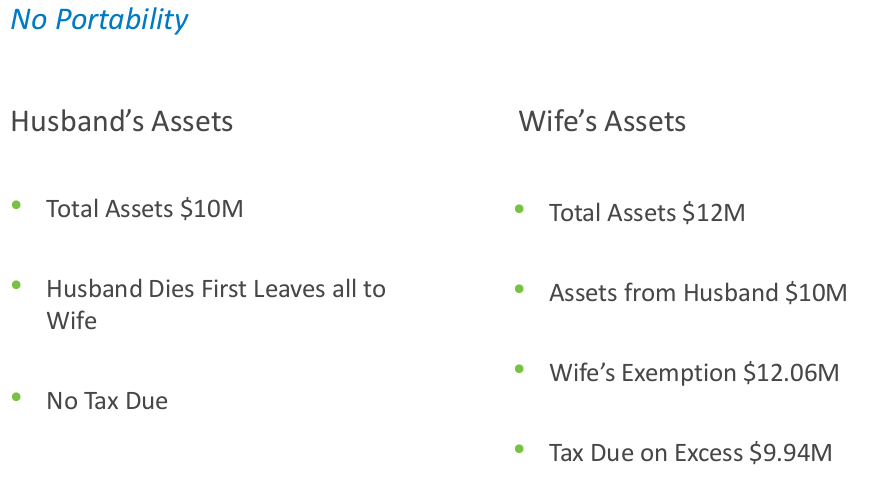

DSUE aka Portability

IRC 2010 Deceased Spouse’s Unused Exclusion aka Portability

(4) Deceased spousal unused exclusion amount

For purposes of this subsection, with respect to a surviving spouse of a deceased spouse dying after December 31, 2010, the term “deceased spousal unused exclusion amount” means the lesser of—

(A) the basic exclusion amount, or

(B) the excess of—

(i) the applicable exclusion amount of the last such deceased spouse of such surviving spouse, over

(ii) the amount with respect to which the tentative tax is determined under section 2001(b)(1) on the estate of such deceased spouse.

IRC 2010 Deceased Spouse’s Unused Exclusion aka Portability

(5) Special rules

(A) Election required -- A deceased spousal unused exclusion amount may not be taken into account by a surviving spouse unless the executor of the estate of the deceased spouse files an estate tax return on which such amount is computed and makes an election on such return that such amount may be so taken into account. Such election, once made, shall be irrevocable. No election may be made under this subparagraph if such return is filed after the time prescribed by law (including extensions) for filing such return.

Portability (DSUE) Applied to Gifts First

· (ii) In determining the extent to which an amount allowable as a credit in computing gift tax payable is based solely on the basic exclusion amount

§ (A) Any deceased spousal unused exclusion (DSUE) amount available to the decedent is deemed to be applied to gifts made by the decedent before the decedent’s basic exclusion amount is applied to those gifts;

§ See §§20.2010-3(b) and 25.2505-2(b).

Example 3 from Regs

· Wife dies when BEA was $11.4M. Wife made no taxable gifts and had no taxable estate.

§ Wife’s estate elects' portability.

· Husband makes no taxable gifts and does not remarry.

§ The BEA on Husband’s date of death is $6.8M.

· Husband’s credit for purposes of computing his estate tax is based on his own $6.8M BEA on his date of death plus the $11.4 million DSUE amount from Wife’s estate.

Restored Exclusion Amount Notice 2017-15

If a decedent made a taxable gift during the decedent's lifetime to the decedent's same-sex spouse and that transfer resulted in a reduction of the decedent's available applicable exclusion amount, there is a new procedure allowing the decedent to restore the exclusion that was utilized in the transfer.

Adequate Disclosure Rules

Valuation for Allocation of Gift Tax Exemption

Value will always be the fair market value of the asset as of the date of the gift.

· Valuation for Allocations of GST Tax Exemption IRC § 2642(b)

§ Timely Filed Gift Tax Return

· FMV as of date of gift

§ Non-Timely Filed Gift Tax Return or a Late Election

· FMV as of date of allocation (automatic?)

· Treas. Reg. 26.2642-2(a)(2)

· Crummey Trusts

Statute of Limitations & Adequate Disclosure

3 Year Statute of Limitation

No Statute of Limitation if Transfers are Not Adequately Disclosed

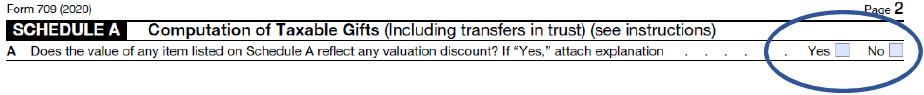

Applies to transfers of interests in corporations and partnerships and interests in trusts with retained rights

Adequate Disclosure CFR § 301.6501(c)-1

(e) Gifts not adequately disclosed on the return.

(2) Adequately shown. A transfer will be considered adequately shown if the return provides

(i)A description of the transactions, including a description of transferred and retained interests and the method (or methods) used to value each;

(ii) The identity of, and relationship between, the transferor, transferee, all other persons participating in the transactions, and all parties related to the transferor holding an equity interest in any entity involved in the transaction; and

(iii) A detailed description (including all actuarial factors and discount rates used) of the method used to determine the amount of the gift arising from the transfer (or taxable event), including, in the case of an equity interest that is not actively traded, the financial and other data used in determining value.

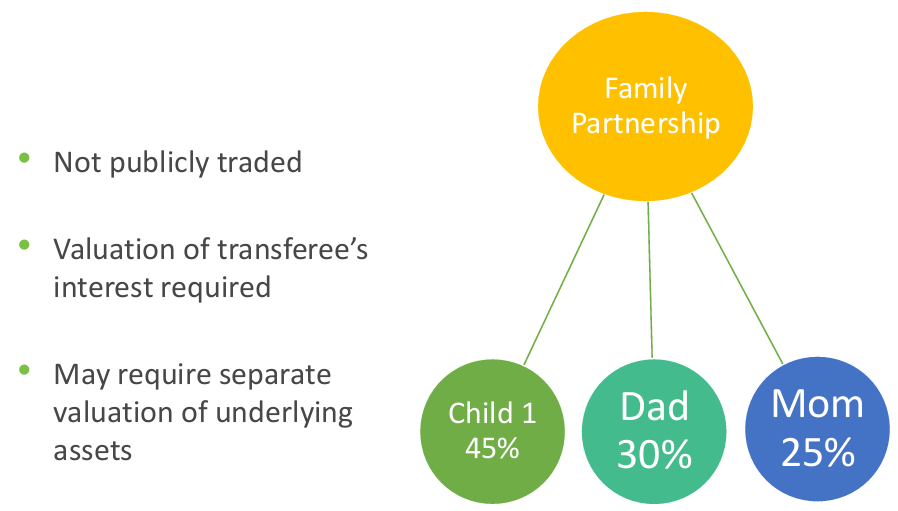

Business Interest Valuations

What is Discounting? Process of valuing an interest in a business for less than the fair market value of the assets * % ownership

What type of discount exist?

· Lack of Control

· Right to choose managers, declare dividends, direct the company, liquidate the business

· Lack of Marketability

· Business’ economic outlook, strength of management, restrictions on transferability

Transfer of Partnership or Corporation

Sample Disclosure

Attached are valuation reports supporting the discounted value of the membership interest in Loving Family LLC, EIN 99-9876543 to the Smith Family 2020 Trust. This valuation applies a 10% lack of control discount and 20% lack of marketability discount to the transfer. The recipient of this transfer is an irrevocable trust created by the taxpayer. The trustee of the trust is Wells Fargo Bank, a corporate fiduciary. The information supplied in the attached valuation reports is specifically intended to satisfy the requirements under CFR 301.6501(c)-1 for purposes of the adequate disclosure rules.

The following are enclosed for your reference:

Copy of 2020 Trust Agreement

Summary of Assets Owned by Loving Family LLC on the Date of Transfer

Valuation Report of the Transferred Interest

Assignments of Interest in LLC to the Trust

Timing of Valuation and Possible Challenges

· Valuations Take Time (2-3 months)

· Valuation may be challenged by IRS and ultimately adjusted

· A subsequent upward adjustment could result in tax (plus penalties) being due for clients who’ve exceeded their lifetime exemption

§ I.E. Taxpayer gifts what he thinks is $12.06M of an LLC interest but then IRS adjusts value to $14.06M

· Tax of $800k + penalties and interest due

· Including a formula clause that allows the taxpayer to reduce the amount of the gift down to $12.06M in the event the underlying valuation is adjusted

Successful Formula Clauses

1. Transfer should be equal to a value as finally determined for federal gift tax purposes AND

2. Include a readjustment clause that provides for a modification of the amount of property transferred in the same manner as a federal estate tax formula marital deduction amount would be adjusted for a valuation redetermination.

Successful Formula Clauses

· Wandry v. Commissioner, T.C. Memo 2012-88 (March 26, 2012)

· “I hereby assign and transfer as gifts ... a sufficient number of my units as a member of [LLC] ... so that the fair market value of such units for federal gift tax purposes shall be ... $XXX. If, after the number of gifted units is determined based on such valuation, the IRS challenges such valuation and a final determination of a different value is made by the IRS or a court of law, the number of gifted units shall be adjusted accordingly so that the value of the number of units gifted to each person equals the amount set forth above, in the same manner as a federal estate tax formula marital deduction amount would be adjusted for a valuation redetermination by the IRS and/or a court of law.”